Download the press release (PDF)

In connection with performance of the previously communicated share issue with pre-emption rights for existing shareholders of approximately SEK 26.8 million before issuing expenses (the “Share Issue”) in Odd Molly International AB (Publ) (“Odd Molly” or the “Company”), with purpose to finance an accelerated online and international investment, representatives from Odd Molly will conduct a number of investor meetings to present the Company’s operations and future plans (the “Presentation”). The investor meetings take place today May 23, 2018 at 16.00 CEST. In connection with the Presentation, new financial information will be announced.

Background and investor meetings

On April 5, 2018, Odd Molly announced the resolution to perform the Share Issue with pre-emption rights for existing shareholders of approximately SEK 26.8 million before issuing expenses, conditional on approval from the Annual General Meeting in 2018. Further, the Company announced a resolved proposal to the Annual General Meeting to authorize the board of directors to resolve on an additional share issue with derogation from the shareholders pre-emption rights to satisfy any oversubscription of the Share Issue. The purpose of the Share Issue is to finance an accelerated investment in sales via digital channels and continued international growth of the Company’s operations. The Annual General Meeting on May 4, 2018, resolved in accordance with the board’s proposals.

The record date for the Share Issue is May 25, 2018 and the last day to trade the share including the right to receive subscription rights in order to participate in the Share Issue is on May 23, 2018. For further information about the Share Issue, please refer to the Company’s website logistea.se.

As a step in the performance of the Share Issue, parts of the Odd Molly management will present the Company’s operations and future plans, as well as new financial information at Erik Penser Bank AB, today on May 23, 2018, at 16.00 CEST. The Presentation from the investor meetings is available on the Company’s website logistea.se. Further information is also available through Erik Penser Bank AB’s website.

New financial information in the Presentation

New financial information below and in the Presentation has not been reviewed or audited by the Company’s auditor.

Sales and operating margin online

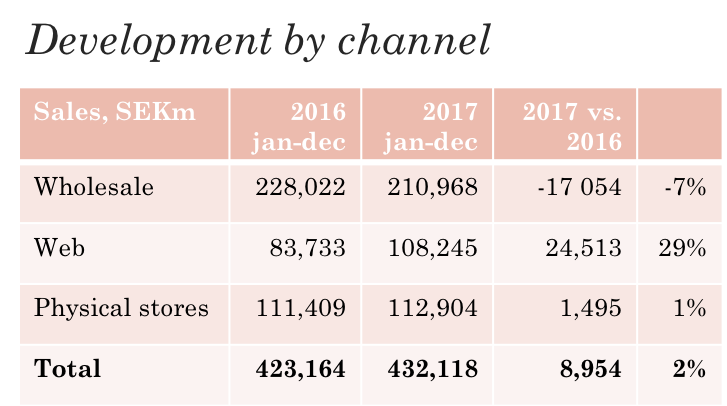

- Sales online, own and external web, reached 40 percent of total sales in 2017

- The average annual growth (CAGR) online, own and external, was 51 percent in the financial years 2012-2017

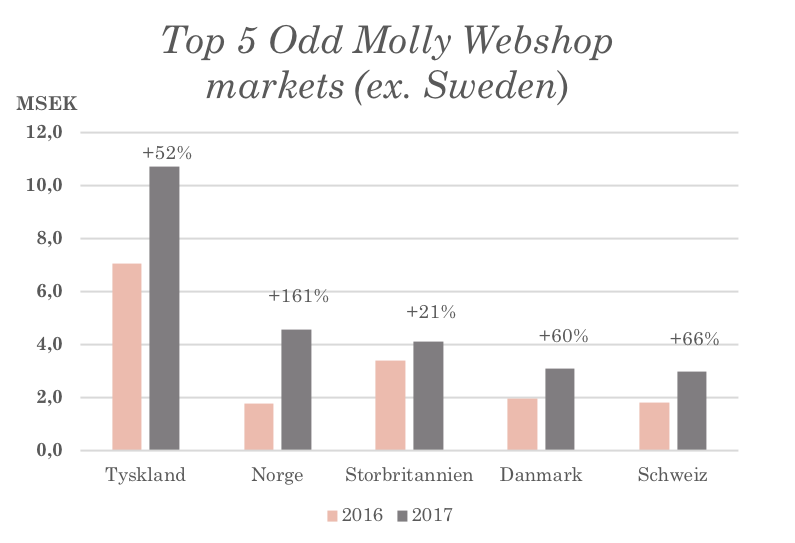

- 35 percent of sales from the own web shop during 2017 were generated from outside Sweden. Growth in the international market through the Company’s own web shop was higher than the Company’s growth on the Swedish market in the same year

- The operating margin (EBIT) on sales through the own web shop amounted to nearly 30 percent during 2017[1]

- In the own web shop, 65 percent were returning customers and 37 percent organic traffic and had an average order value of SEK 1,279 in 2017

Sales in own channels

- Sales in own channels amounted to 50 percent of total sales during 2017

- The average annual growth (CAGR) in own channels was 44 percent in the financial years 2012-2017

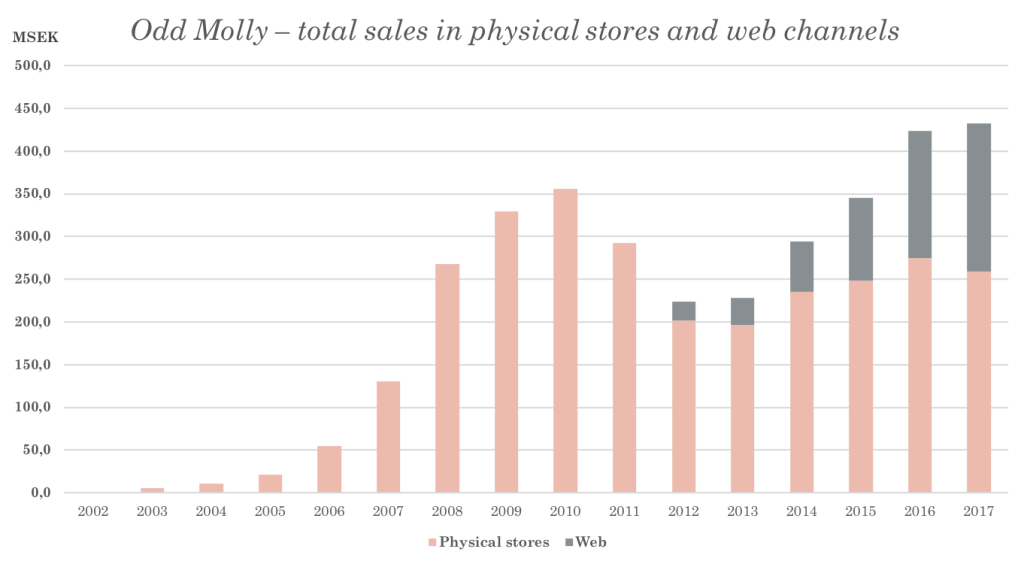

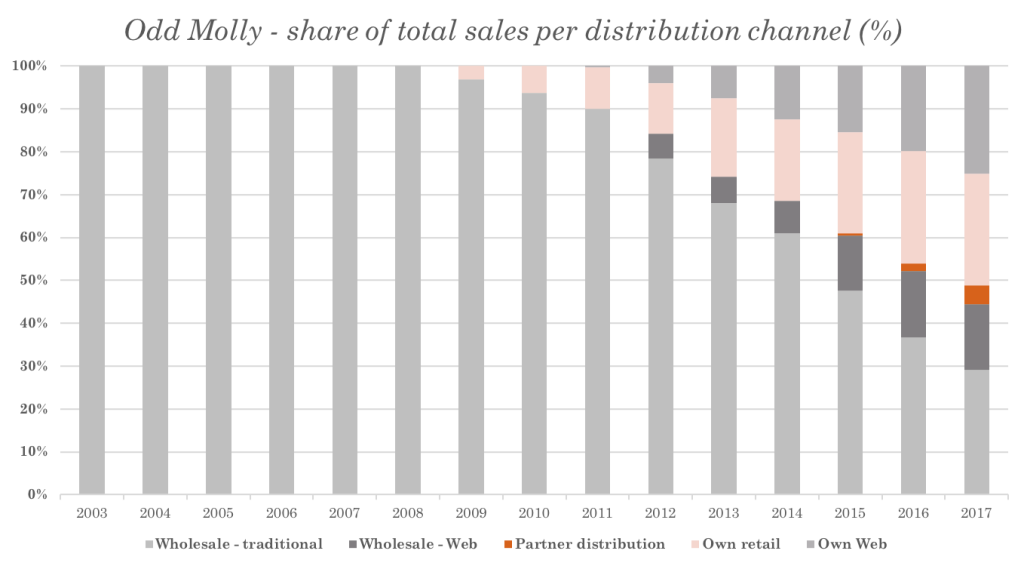

Below diagrams from the Presentation show the Company’s distribution of total sales per distribution channel.

DIAGRAM SLIDE 7 – development total sales physical stores/web

DIAGRAM SLIDE 8 – development distribution own/ext./physical/web

DIAGRAM SLIDE 11 – own web sales internationally 2016/2017

TABLE SLIDE 16 – sales distribution 2016/2017

For additional information, please contact:

Johanna Palm, CFO, +46 760 10 24 55

Patrik Tillman, Chairman of the Board, +46 733 50 61 20

This information is information that Odd Molly is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication through the agency of the contact persons set out above, on May 23, 2018, at 15.00 CEST.

About Odd Molly

Odd Molly is a Swedish company that designs, markets and sells distinctive fashion. The Company’s products are mainly sold through own channels as well as through own sales teams and external agents to retailers. An increasing proportion of sales are derived from Odd Molly’s own channels, mainly the Company’s webshop, which reaches close to 40 countries. Furthermore, Odd Molly has 18 own stores as well as stores managed by partners on selected markets. The Odd Molly share is traded on Nasdaq Stockholm, small cap. Read more on logistea.se.

Odd Molly International AB, Kornhamnstorg 6, 111 27 STOCKHOLM, Sweden, Phone: +46 8 522 28 500, www.oddmolly.com

Important Information

The information in this press release, and the Presentation referred to in this press release, does contain or constitute an offer to acquire, sell or otherwise trade in securities in the Company. The information in this press release or the Presentation may not be released, published or distributed, directly or indirectly, in or into the United States, Canada, Australia, Japan, Hong Kong, Switzerland, New Zealand, Singapore, South Africa or any other jurisdiction in which such action is subject to legal restrictions or would require other measures than those required by Swedish law. No shares or other securities mentioned in this press release or the Presentation have been registered, and no shares or other securities will be registered, under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) and no shares or other securities may be offered, sold or otherwise transferred, directly or indirectly, in or into the United States, except under an available exemption from, or in a transaction not subject to, the registration requirements under the U.S. Securities Act and in compliance with the securities legislation in the relevant state or any other jurisdiction of the United States. No action has been taken and measures will not be taken to permit or register a public offering in any jurisdictions other than Sweden.

An offering through the Share Issue referred to in this press release is made by means of the prospectus referred to herein. This press release or the Presentation is not a prospectus for the purposes of Directive 2003/71/EC (together with any applicable implementing measures in any Member State, the “Prospectus Directive”). Investors should not invest in any securities referred to in this press release except on the basis of information contained in the aforementioned prospectus.

[1] Operating margin before group-wide costs